Select Energy Services Reports 2017 Third Quarter Results

– Third quarter revenue of $153.9 million, a 14.5% increase over the second quarter

– On November 1, completed its merger with Rockwater Energy Solutions, giving Select a market capitalization of approximately $1.7 billion

HOUSTON, Nov. 8, 2017 /PRNewswire/ — Select Energy Services, Inc. (NYSE: WTTR) (“Select” or “the Company”), a leading provider of total water solutions to the U.S. unconventional oil and gas industry, today announced results for the third quarter ended September 30, 2017. As previously announced, Select completed its merger with Rockwater Energy Solutions, Inc. on November 1, 2017. All reported financial results for Select for the third quarter of 2017 are on a standalone basis.

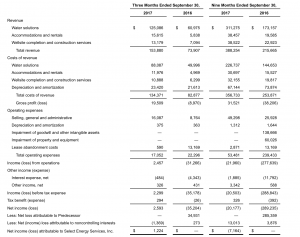

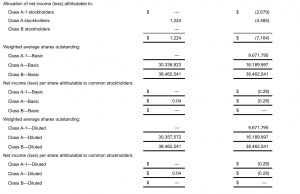

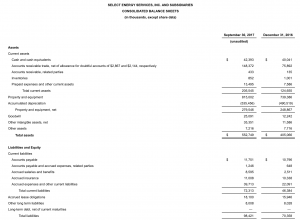

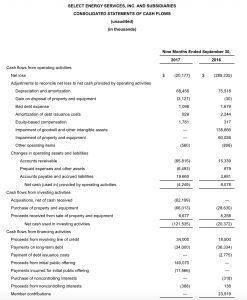

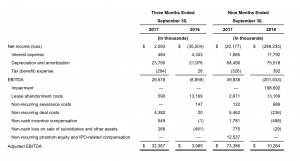

Revenue for the third quarter of 2017 was $153.9 million, a 14.5% increase compared to $134.4 million in the second quarter of 2017 and a 108% increase compared to $73.9 million in the third quarter of 2016. Net income for the third quarter was $2.6 million as compared to a net loss of $10.5 million in the second quarter of 2017 and a net loss of $35.2 million in the third quarter of 2016. Adjusted EBITDA was $32.4 million in the third quarter of 2017 compared to $27.3 million in the second quarter of 2017 and $4.0 million in the third quarter of 2016. Please refer to the reconciliation of Adjusted EBITDA (a non-GAAP measure) to net loss (a GAAP measure) in this release.

John Schmitz, Select’s Executive Chairman, stated, “We are extremely pleased with our third quarter operational results which benefitted from continued momentum in completion-related activity, resulting in strong revenue growth and profitability. Additionally, we are very excited to have completed our merger with Rockwater and look forward to what we can achieve as a combined company.”

Holli Ladhani, President and CEO, added, “We believe that our third quarter results, including our return to net income profitability for the first time since the downturn began in 2014, demonstrate the value of our water solutions platform as well as the strength of our employees. The integration of these two leading companies is well underway and we couldn’t be more excited about the opportunities ahead of us.”

Conference Call

Select has scheduled a conference call on Thursday, November 9, 2017 at 10:00 a.m. eastern time. Please dial 201-389-0872 and ask for the Select Energy Services call at least 10 minutes prior to the start time, or live over the Internet by logging on to the web at the address http://investors.selectenergyservices.com/events-and-presentations. A telephonic replay of the conference call will be available through November 16, 2017 and may be accessed by calling 201-612-7415 using passcode 13672864#. A webcast archive will also be available at the link above shortly after the call and will be accessible for approximately 90 days.

About Select Energy Services, Inc.

Select is a leading provider of total water solutions to the North American unconventional oil and gas industry. Select provides for the sourcing and transfer of water, both by permanent pipeline and temporary hose, prior to its use in the drilling and completion activities associated with hydraulic fracturing, as well as complementary water-related services that support oil and gas well completion and production activities, including containment, monitoring, treatment and recycling, flowback, hauling, and disposal. Select, under its Rockwater Energy Solutions brand, also develops and manufactures a full suite of specialty chemicals used in the well completion process and production chemicals used to enhance performance over the producing life of a well. Select currently provides services to exploration and production companies and oilfield service companies operating in all the major shale and producing basins in the U.S. and Western Canada. For more information, please visit Select’s website, https://www.selectenergy.com.

Cautionary Statement Regarding Forward-Looking Statements

All statements in this communication other than statements of historical facts are forward-looking statements which contain our current expectations about our future results. We have attempted to identify any forward-looking statements by using words such as “expect,” “will,” “estimate” and other similar expressions. Although we believe that the expectations reflected, and the assumptions or bases underlying our forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. Such statements are not guarantees of future performance or events and are subject to known and unknown risks and uncertainties that could cause our actual results, events or financial positions to differ materially from those included within or implied by such forward-looking statements. Factors that could materially impact such forward-looking statements include, but are not limited to, the factors discussed or referenced in the “Risk Factors” section of the prospectus we filed with the SEC on April 24, 2017, relating to our recently completed initial public offering and the “Risk Factors” section of our most recent Quarterly Report on Form 10-Q filed with the SEC. Investors should not place undue reliance on our forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, unless required by law.

Comparison of Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA are not financial measures presented in accordance with GAAP. We believe that the presentation of these non-GAAP financial measures will provide useful information to investors in assessing our financial performance and results of operations. Net income is the GAAP measure most directly comparable to EBITDA and Adjusted EBITDA. Our non-GAAP financial measures should not be considered as alternatives to the most directly comparable GAAP financial measure. Each of these non-GAAP financial measures has important limitations as an analytical tool due to exclusion of some but not all items that affect the most directly comparable GAAP financial measures. You should not consider EBITDA or Adjusted EBITDA in isolation or as substitutes for an analysis of our results as reported under GAAP. Because EBITDA and Adjusted EBITDA may be defined differently by other companies in our industry, our definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies, thereby diminishing their utility. For further discussion, please see “Summary—Summary Consolidated Financial Data” in our Final Prospectus.

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to our net income or net loss, which is the most directly comparable GAAP measure for the periods presented:

CONTACTS

Select Energy Services

Gary Gillette, CFO & SVP

Justin Briscoe, SVP, Business Development

(940) 668-0259

IR@selectenergyservices.com

Dennard ▪ Lascar Associates

Ken Dennard / Lisa Elliott

713-529-6600

WTTR@dennardlascar.com

View original content:http://www.prnewswire.com/news-releases/select-energy-services-reports-2017-third-quarter-results-300552319.html

SOURCE Select Energy Services, Inc.